What

Prequalified Means

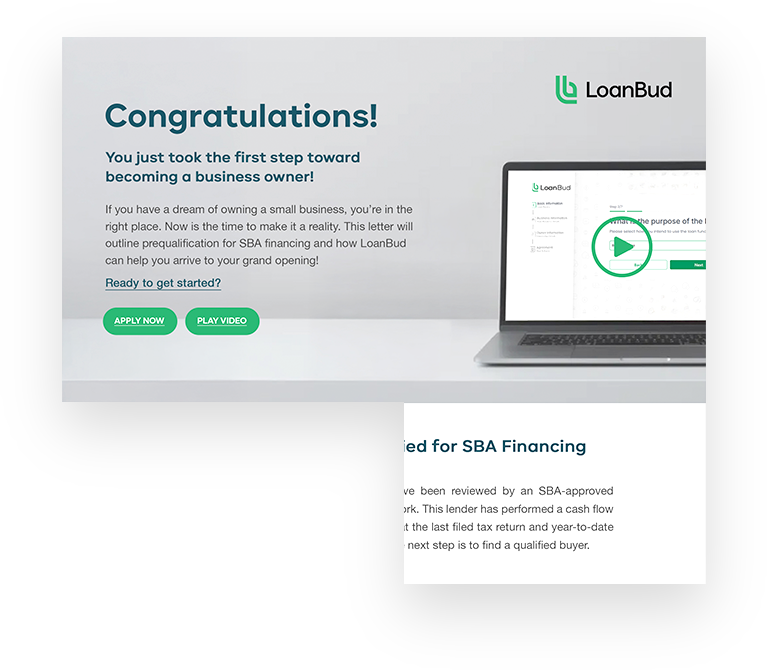

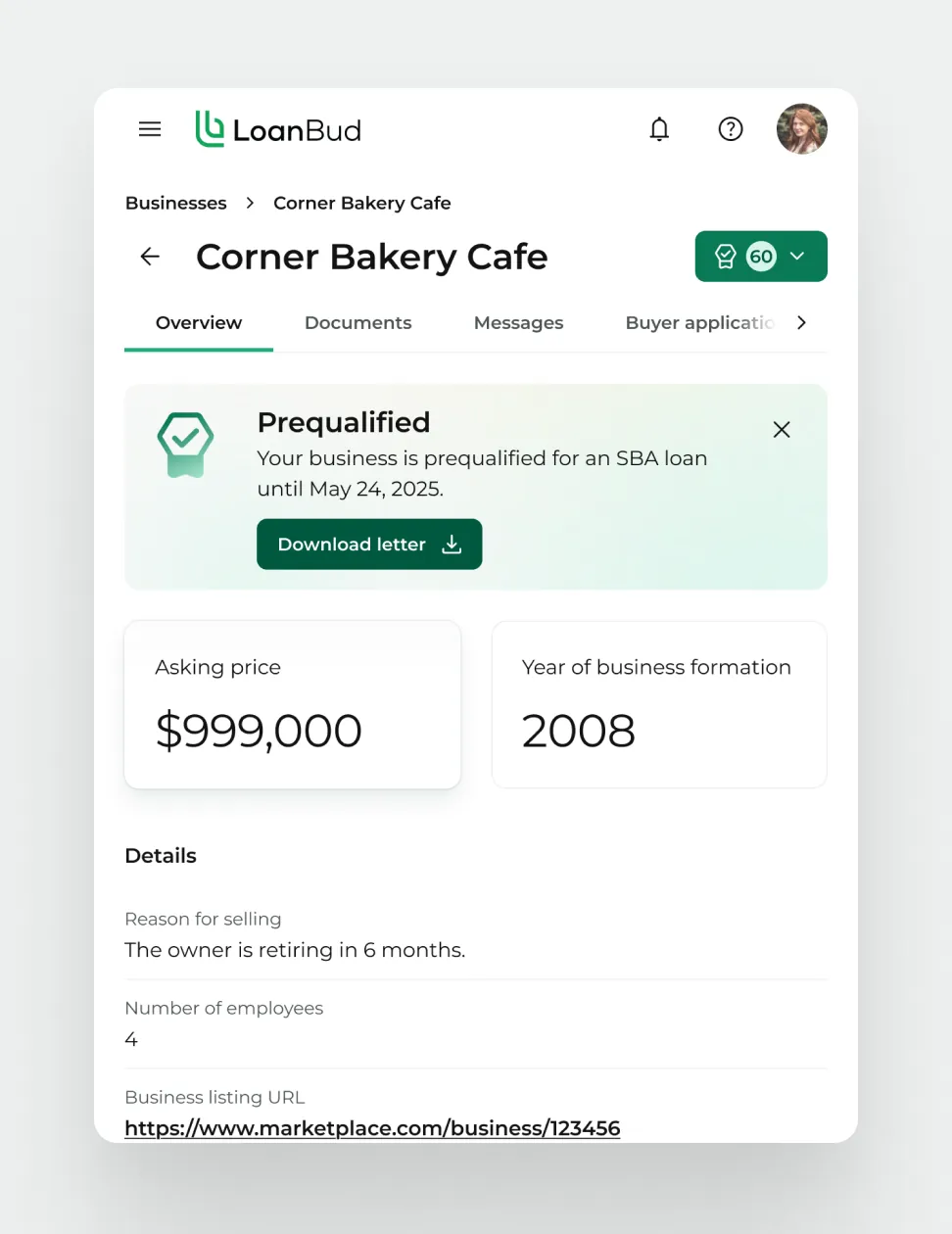

The business has been Prequalified for SBA Financing

Financials have been reviewed and are up to date

A buyer can directly apply for financing to acquire your business

Getting Prequalified for SBA Financing with LoanBud makes it easy to sell your business. Help your business stand out, attract serious buyers, and streamline financing so you can close faster and at maximum value.

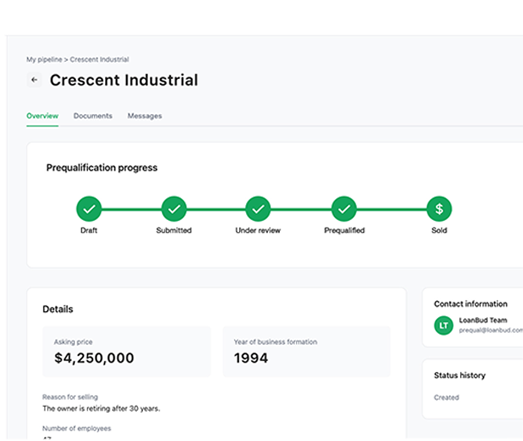

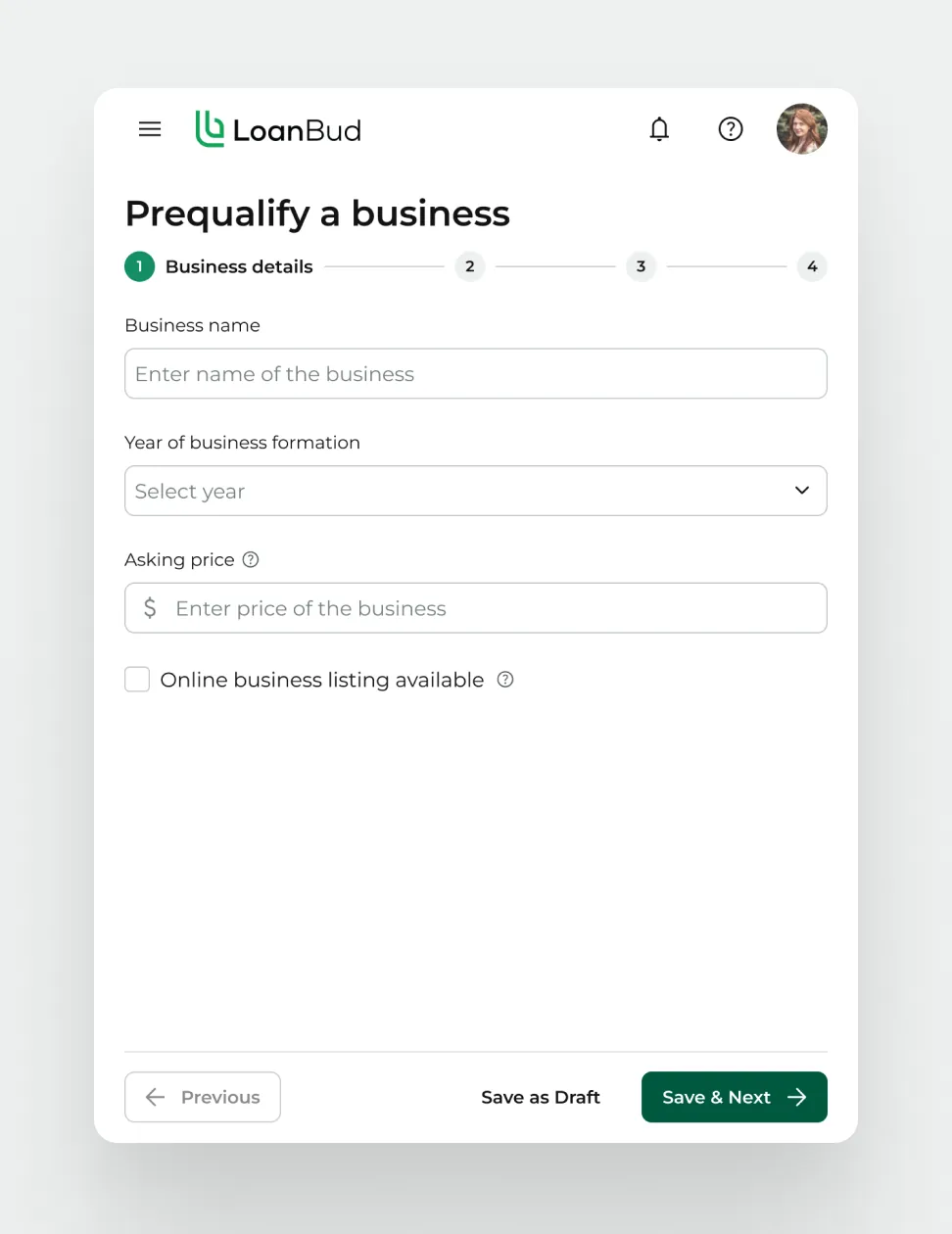

Prequalify a business for SBA financing in just 1–2 days

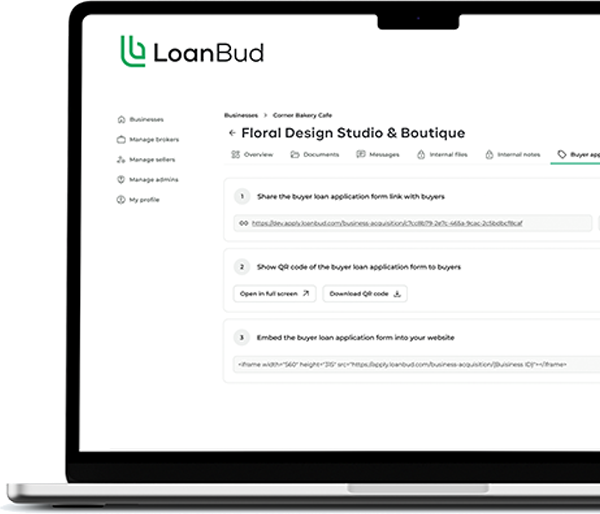

Market your listing as Prequalified to attract more buyers

Enable financing applications on your listing and track every buyer in real-time

Close deals faster with LoanBud as your guide

makes SBA Financing for business acquisitions simple

The business has been Prequalified for SBA Financing

Financials have been reviewed and are up to date

A buyer can directly apply for financing to acquire your business

Register your business

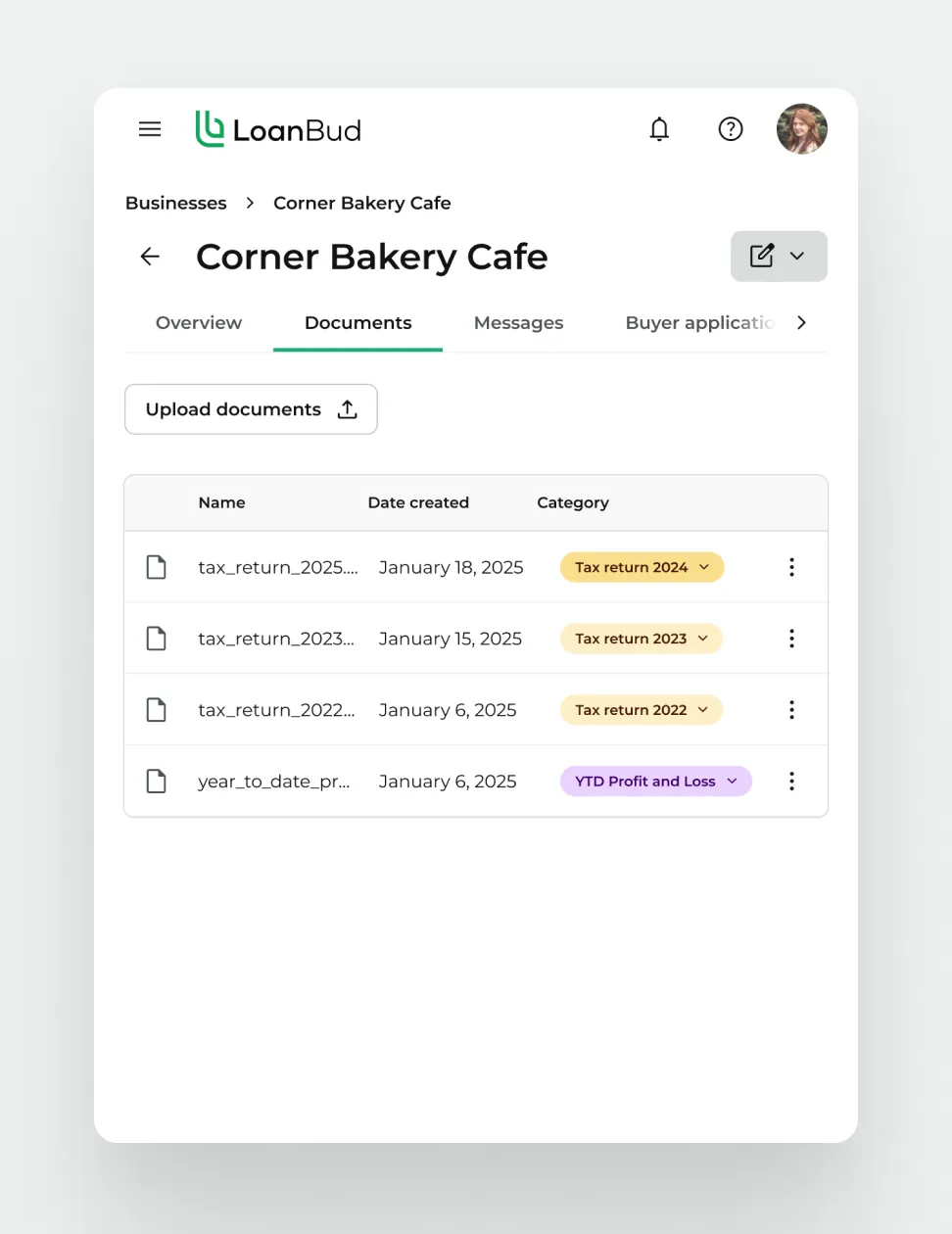

Upload Seller Financials.

LoanBud Prequalifies in 1-2 Days.

Register your business

Upload Seller Financials.

LoanBud Prequalifies in 1-2 Days.

LoanBud is a financial technology platform dedicated to SBA financing, connecting entrepreneurs to a nationwide network of lenders. LoanBud is your guide and advocate, streamlining the financing process to save you time and close your business sale with confidence.

Prequalifying for SBA Financing makes it easy for someone to buy your business. LoanBud saves you time and helps you close more deals.

LoanBud makes SBA financing easy - for busy small business owners, brokers and future entrepreneurs

Industry's first SBA prequalification platform

Dedicated team of SBA Financing experts handle the complexity for you

Large network of lenders ensures more deals are closed

Dual-sided screening process

Transparent communication every step of the way

Attract more buyers and maximize your sale price

Show buyers the financials have been reviewed by an SBA Lender

LoanBud streamlines the financing process

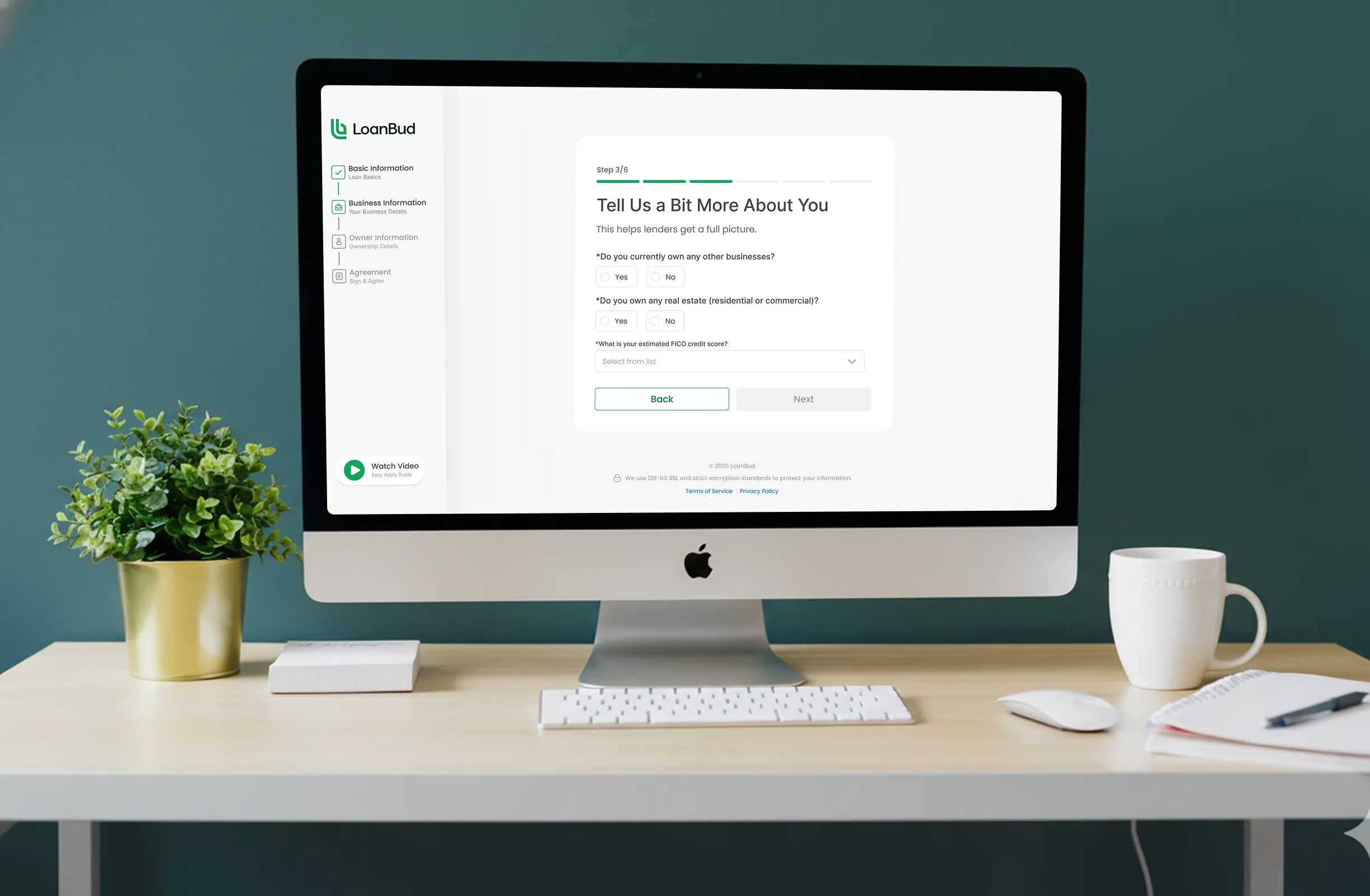

Create a frictionless path for buyers

LoanBud takes the headache out of the financing process

Minimum FICO score of 650+

Documentation of assets, liabilities, and net worth

Collection of three years of personal tax returns

Resume review to confirm SBA-required experience

LoanBud helps buyers finance business purchases with SBA loans. Each listing has its own financing application URL, making it easy for buyers to apply.